War, Volatility and Energy - The Macro Economics of the 2020's

The Russian invasion of Ukraine might just mark the official end of “The Petrodollar '' and the United States’s economic dominance on the world stage. But… I’m getting ahead of myself.

Hello everyone, welcome to the first edition of the WTF Newsletter. If you want to get access to my private telegram group with the next newsletter, sign up for a free subscription.

(This newsletter represents the opinion of the writer only and does not constitute financial advice.)

This edition will be focused on macroeconomics. There is so much to talk about, too much in fact. So the goal of this letter will be to paint a picture of the macro trends we are caught up in over the next decade. Hopefully, if we can identify these trends well enough, we can swim downstream whenever possible and harness our energies so that when it's time to go against the curve we can score some big wins.

To paraphrase my friend and mentor Ugly Old Goat…

“If you don’t play, you can’t win. So the only way to win is to stay in the game.”

I suppose we should start with the most obvious question.

WTF is going on with the markets?

You probably noticed the crypto markets had a serious crash in recent months.

Bitcoin is down 64% from the all-time high for a total correction of -74% at the low so far. Ethereum went down as much as 81%, currently standing at a -64% from its all-time high. Multiple major liquidations of ‘DEFI’ lending platforms, specifically referred to as CEFI, because of their explicitly centralized nature. Not everything is dead in Ethereum, some ‘DEFI’ protocols that were over-collateralized survived, and believe it or not there are still people buying and selling NFTs.

Nevertheless, we’ve seen a massive amount of capital leave the crypto markets or be outright destroyed. Celsius, Voyager, Blockfi and even a sketchy but very large crypto hedge fund called Three Arrows Capital all went bankrupt. Blockfi among a few others is currently being bailed out by the FTX exchange. Last but not least, the algorithmic and “decentralized” “stablecoin” USDT blew up entirely, taking down much of the aforementioned with it. Heck, even Elon Musk sold 75% of Tesla’s Bitcoin during this downturn. Needless to say, it has been epic.

The crash is however not contained to crypto.

The S&P 500 went as low as -24% from its ATH, along with the Dow Jones (-19%) and Nasdaq losing as much as 34% from the high. Those are big numbers for the cream of the economic crop.

Of course, none of this can be looked at in isolation. Russia’s invasion of Ukraine has had a fundamental impact on global economics in my estimation. I firmly believe it will be considered a historical landmark for economics this century, as it marked a formal departure of a major power from the “Liberal world order” that had ruled for almost a century.

In fact, Russia’s invasion of Ukraine might just mark the official end of “The Petrodollar '' and the United States’s economic dominance on the world stage. But… I’m getting ahead of myself.

Russia, Russia, Russia

Let's talk about Russia for a moment. You might recall the past ten years of media coverage from the west. The “Russia collusion” narrative that we had to put up with during the late 2020s every day on the news? The rising vilification of Putin (who is no dove obviously).

The attempt to bring back a cold-war-style panic of the Ruskies. As if Russia was still under Soviet communist control. As if the whole thing had not collapsed in the early 90s. As if Russia didn’t have Starbucks stores and Mcdonald’s franchises for the past 20 years.

As if their people were not actively becoming westernized to whatever degree that is possible.

Needless to say much of that momentum towards Russia joining the big happy family of western globalism seems behind us now and for the foreseeable future. After Russia invaded Ukraine - which has done untold damage to Ukrainians, the only real victims in this giant geopolitical chess match - the US sanctioned and attempted to isolate Russia from the world economy.

Do you want to do business with Russia? Nope, not happening. People think sanctions are an attack on an enemy nation. In reality, they are an attack on your own population’s economic freedoms. It is Americans and Europeans that are under threat from western powers if they dare do business with the Russians. And Russia seems relatively unfazed by it. While their economy has taken damage, the Rubble is stronger than ever. The strongest performing currencies this year, actually.

“Oh, but their markets are manipulated!”

Yeah, so are ours. The FED is in full-on damage control doing shadow QE while “fighting inflation” and raising rates, as the European Central Bank announces they are willing to do “Unlimited buying” of the bond markets to keep them stable. We are in an economic war with Russia my frens, and what’s left of the dollarized economy is the vessel that they have to keep steady. Whether they can or for how long is a different question. Back to Russia, the US didn’t just use the power of the SWIFT international settlement system to cut off Russia and threaten western companies to boycott. No, they went a step further. The US confiscated Russian treasury reserves held within western reach, limiting Russia’s ability to make payments to those holding Russian sovereign debt.

This is a big deal. It’s a big deal not only because it lead to a Russian “default” on sovereign debt denominated in US dollars, cutting off a major power from the dollar system. But also because it sends a message to other nations. If you cross American foreign policy, you could have your reserves confiscated as well, and face default. This is a breach of the neutrality of global markets which was probably a bridge too far.

Now any nation that wants to retain its sovereignty and not be essentially integrated into US foreign policy will have to consider avoiding treasury reserve exposure to US powers. In other words, the global economic order is becoming undone.

We all know what the west thinks of Putin’s intentions, they think Russia wants to invade all of Europe, or something akin to that. But what does Putin claim is his motive for invading? Over the past decade at least he has drawn a line on the sand around Ukraine, making it very clear that if NATO the European military alliance expanded into Ukraine, it would cause conflict.

Well, they delivered. Just imagine what the US would do if Russia set up military bases in Cuba, let alone bioweapon research facilities or nuclear launch pads.

It’s not clear to me that NATO had nuclear capabilities in Ukraine, but if Ukraine was added to NATO, it would be a green light for such a program. For the Ruskies, that’s a hard no. But there’s more, the PetroDollar is now at risk.

Energy & The PetroDollar

I’ve been going deep into the energy rabbit hole over the past year or so. Not gonna lie, Michael Saylor’s podcast appearances and thoughts on the topic really lit a lightbulb for me. Energy, it appears is the lifeblood of the economy - it really is. That’s more obvious than ever now, isn't it? Gas goes up? Everything gets more expensive. Gas goes down, everything gets cheaper! It’s a fairly simple equation. The energy narrative in the west these days is thus, not progressive but regressive. The more energy we consume and in turn produce, the more our civilization is growing. The outputs of these processes should be observed for sure, even managed - but the apocalyptic fears being pushed by the liberal establishment, scaring the pants off a whole generation of millennials, is frankly criminal.

I’m not gonna get into the science of climate change -not today anyway- other than to say that margins of error in projections of trends tend to go exponential over time. This might explain the doomsday FUD around climate change and the infamous hockey stick chart.

Instead, however, I’m gonna empower you with some meme facts :).

Why is this relevant? Because Russia did not buy this energy FUD and neither did China which is in the middle of building 6 nuclear power plants throughout the country. Russia is allegedly one of the 6 largest producers of oil in the world while being the second largest producer of natural gas. Meanwhile, Saudi Arabia is the second largest producer of oil in the world. And they are making bank with this economic war. Buying cheap Russian oil and selling their own at much higher prices to the west. Europe did however drink their own ESG kool-aid and the side effects are being felt. Nuclear power throughout the west has been actively discouraged. The oil and gas industry in the west has been under attack from its own governments for more than a decade resulting in little investment into the future of oil production.

Germany shut down coal miners and allowed their dependency on Russian gas to grow, now they are facing energy costs so high that it has neutered their manufacturing industry. On top of that, the winter is coming threatening to punish its citizenry with energy shortages and little heating during the winter. There are literal shortages in dry wood and fire stoves now as the German population panics, going back to the iron age to try and survive the winter.

Trump warned them too. Famously said, “Germany will become dependent on Russian gas” at the UN years ago and was mocked by the joke of a western elite we suffer under.

And that’s the trend change. Energy independence thanks to Russia’s invasion of Ukraine is now a matter of national security and Europe is leading the way.

Germany is now forced to re-activate coal power plants in a rush, separating themselves from the top-down fascist ESG goals of civilization seppuku that western elites are so fond of. And let’s face it, Germany is the engine and economic leader of the European Union.

Elon Musk, the global industry leader in the production of sustainable energy technology has somehow been de-ranked from ESG standards, right around the time he decided to try and buy Twitter and announced he would be voting Republican. He in turn heavily criticized the ESG structure and movement, pointing out how inconsistent and selectively its standards can be applied.

ESG, weaponized vs Elon Musk

France has postponed their goals to reduce its Nuclear power capabilities by 50% from 2025 to 2035. How is nuclear power dirty btw? Seems like it’s the only real path forward. Nuclear energy technology has come a long way since Chernobyl, we could probably shoot whatever waste there is into space and never see it again.

These are all good things, in the grand scheme of things. ESG is increasingly looking like the top heavy communist pile of selective dogshit that it is, and energy independence is now unequivocally a national security concern for all nations of the world.

The Saudis, The Petrodollar, And The BRICS

As I mentioned above, the Saudis are playing this like geniuses. Buying up cheap Russian oil and selling their own at high prices to the west, in a kind of sanction arbitrage. Meanwhile, the Petrodollar, the cornerstone of the US Dollar’s leverage over the world economy is increasingly weakened.

The petrodollar, in case you aren't familiar, is an old alliance between the US and Saudi Arabia. The Saudis sell all their oil only for dollars and in exchange, the US sells them weapons of war and protects them and their interests in the middle east. This alliance is more than 50 years old now and it marked the official departure of the Dollar from a gold standard in 1970.

This alliance has come under pressure in recent years as diplomatic relations between the US and Saudi Arabia are strained. There’s a long list of drama that has harmed this relationship, but the most recent sign of a trend change in regards to the petrodollar came early this year, as the Saudis were reportedly considering selling oil for Yuan.

(Compare that fist bump to this handshake lol -and then come right back! :D)

The situation is becoming so precarious that Biden was recently seen fist bumping the Saudi Crown Prince, Muhammed bin Salaman, visiting Saudi Arabia to negotiate down gas prices from a very weak position. Gas prices in the US have risen to levels not seen since the 2008 financial crisis as the sanctions on Russia cut off a major supply source from the west, while Biden’s approval ratings also make records, but to the downside.

Biden and the democrats need some victories as midterm elections get closer and gas prices are likely the most important issue on the ballot box.

While crude oil has indeed begun to retreat below 100 USD a barrel and this attempt to reinvigorate the US-Saudi alliance might lower gas prices for a few months. It might not be enough to reverse the trend away from the dollar as a global reserve currency data.

The confiscation of Russia’s treasury reserves might just be the catalyst that will accelerate this trend. Certainly, the argument towards being dependent and exposed to US foreign policy interests seems to be weaker than ever, as the US wobbles with rising cultural and political instability. No empire lasts forever and, while the principles that founded the United States might last forever, its current top-heavy government structure and bureaucracy are long due for large-scale reform.

We will see how this plays out in the future, but I’m expecting more systemic implosion in the US as states challenge federal edicts and the country further separates itself along political lines.

Despite all of the above, the dollar remains the strongest currency in the world, in particular when compared to all the others, but there is blood in the water, and the BRICS nations are organizing. Russia recently announced a competing system to SWIFT, claiming that it is ready to be used. The System for Transfer of Financial Messages (SPFS) allows the routing of fiat payments between the 5 allied nations and was developed to mirror SWIFT after sanctions against Russia were first imposed during their invasion of Crimea.

However, this is much larger than just a competitor to SWIFT among a third of the world’s population & GDP. It is the foundation on top of which a competing reserve currency can be developed.

"The matter of creating the international reserve currency based on the basket of currencies of our countries is under review," Said the Russian leader at the BRICS Summit earlier this summer.

So the trend here is toward a multi-polar world, where Western power is increasingly challenged and sanctions no longer hold the weight they once did. It will be curious to see how Venezuela and Cuba adapt to these tectonic changes as well as the rest of Latino America.

That said, it’s not like it’s all sunshine and rainbows in the east. China’s economy is currently under some serious stress as they continue to screw their own economies with the zero covid nonsense. A situation partly to blame for the inflation experienced in the west, as the Chinese supply of goods shrinks making prices go up. This brings us to the FED.

Bitcoin, Inflation, and the FED

The past few months have been wild. We already talked about the correction of the markets throughout this year. But when can we expect Bitcoin at least to recover? This year has brought a lot of revelations for me in terms of the markets. Many narratives that grew throughout the bull market are being tested hard, some of them have been completely destroyed. Like the Stock To Flow model as applied to Bitcoin which foresaw prices as high as 250k during this recent cycle. Or questions about Bitcoin as an inflation hedge.

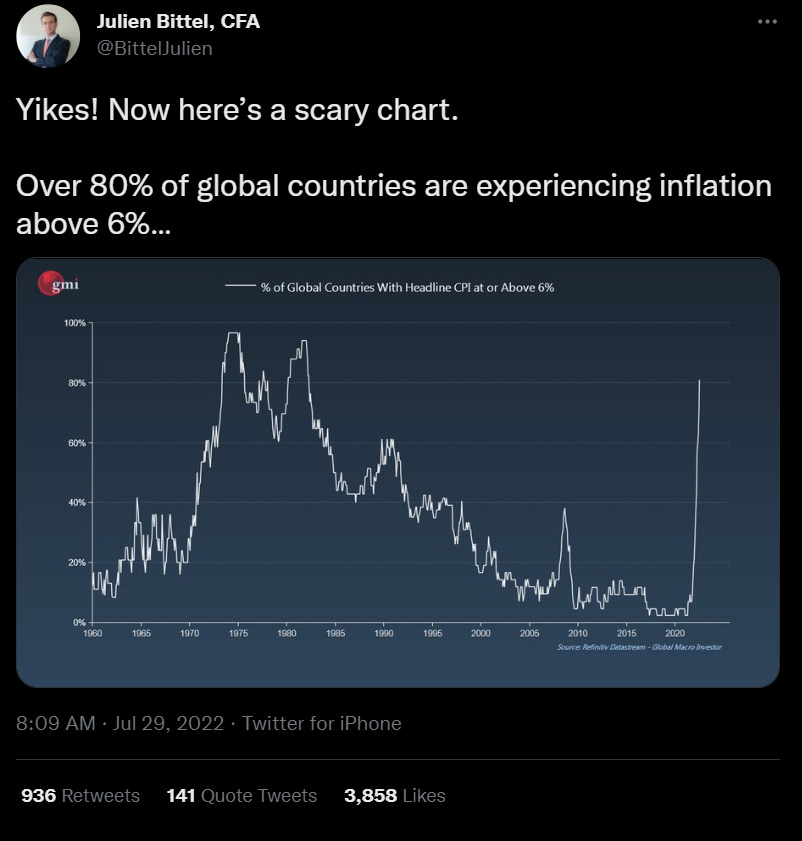

When inflation is at an official 9.1% (likely closer to 20% in the US) per year. A 70% correction on your inflation hedge comes off a little suspect. Is Bitcoin thus not a good inflation hedge? And if not then what the hell is it good for? These are fair questions, and everyone that is seriously investing in Bitcoin seriously is probably considering them.The last big article of this sort that I wrote expected Bitcoin to continue to compete with gold (might have gotten a bit ahead of myself there). I mentioned that 30k USD a Bitcoin was possible and that 20k was a bargain for BTC. I didn’t however expect us to come down to 20k and stay here for this long. As I write this, the markets are slowly recovering. It is not clear to me that the bottom is in. It might be, I’d say I have 65% confidence that the bottom is in, but we could just as easily continue to test 20k. And sadly, at least for now, that depends on the FED.

You see, most of the speculative money out there seems to think of Bitcoin as a high-tech risk-on asset. It means they don’t look at it as a store of value, as a hedge against inflation, or as a hedge against confiscation risk. They go on centralized exchanges and YOLO long it when it’s on a bull market. Then GTFO when things get a little weird. Most speculators don’t see Bitcoin for what it actually is, a hedge against the credit-based dollar-denominated system.

Bitcoin is fundamentally a settlement layer for value. It doesn’t require credit or debt in order to move balances across space. Bitcoin is always a bearer asset (when not in exchanges) and so it eliminates counterparty risk when you hold it in your portfolio and control your own keys.

As we have seen with all these ‘CEFI’ platforms that blew up in recent months, counterparty risk remains a real thing in the crypto industry. Meanwhile, counterparty risk has entered the big league treasury reserves market, with the US’s confiscation of Russian reserves. The developing world and the BRICS, are starting to understand the reality of counterparty risk at the deepest levels of the global economy. US speculators are likely to be the last to recognize it.As long as the dollar credit-based system continues to function, Bitcoin will likely continue to trade as a risk-on asset, and as a hedge for those that understand it as such. So what does the FED have to do with this? Well, the FED is pretending to care about inflation by raising interest rates and thus making credit more expensive - shrinking demand for goods, which should lower prices. But they are also buying the markets. In particular, they are manipulating the bond markets right now, and this is what I call stealth QE.

It’s not clear exactly what they are doing, likely the ECB is buying US bonds as the US buying EU bonds. Possibly even Japanese bonds. This fact has yet to enter the mainstream economic discussion. How do I know this? Well, look at this chart.

This is the 10-year US Bond market. On February 24th, Russia invaded Ukraine, followed by a collapse in the US10Y bonds of about 12% over a few weeks. See that May 22nd recovery? That was literally overnight. How many hundreds of billions of dollars would need to be moved to raise the price of US bonds by 11% overnight? Were these mom-and-pop buyers? It wasn’t China that bought them, nor Russia.

Literally, overnight the price went back up to baseline. That’s manipulation folks. Only Federal banks can do that. That’s Shadow QE. While the FED tells you with one hand that they really care about inflation and are willing to crash the economy to get it back down to 2%. With the other hand they are printing dollars by the hundreds of billions, likely trillions to stabilize both the US economy and the EU’s. That shadow QE will eventually return home.Then, if the economy isn’t moving fast enough, inflation will return with a vengeance.

Then Gold will pump and finally break out of $2000, and Bitcoin will follow, finally establishing its place in the global markets as a risk-off asset.

Meanwhile, however, given the mid-terms in the US are near, and given the massive correction the markets just experienced, I’m expecting the Fed to keep low-key buying the dip in an attempt to rebuild confidence from all parties. This will likely pump the stock market for a few months, maybe a year. Or at least slow down the collapse. We’ll see how long it lasts.

Final Thoughts

Alright, everybody. That’s more than 3000 words on the big picture, with some dips into short-term volatility. Right now, I think it makes sense to have physical cash and non-perishable food just in case. Doesn’t hurt to have it and it helps a lot if you need it. Bitcoin is way oversold by all metrics and thus, it seems to me very safe to begin buying here and dollar cost averaging in. Same for Gold. But cash will continue to be useful, especially in a short-term crisis.

When this bizarro scheme finally comes undone, those that have the ability to buy, those with cash on hand will make fortunes. Hopefully, as we continue to have this conversation, we’ll figure out how to position ourselves to not just survive the great reset, but convert it into a more stable world, and thrive.

All the best.

Juan Galt.